The Sacramento market is poised for sustained population growth for the foreseeable future. This bodes well for all market segments, primarily for Retail and Multifamily. The Office market would be doing just fine if the State wasn’t vacating millions of square feet Downtown, along Highway 50, and out to Natomas.

Before the Pandemic, Downtown was the crown jewel. Frankly, it was on fire. It will likely be another tough year for Downtown, but I am confident that Downtown will shine again! Everything that was there is still there, except office workers. And while we do have a significant challenge with the homeless population, I am confident that with the right leadership, the homeless population will be addressed.

Will the State come back to the office? Well, as of January 2024, the State is encouraging agencies to return to the office – But only for two days a week. Until the State returns to the office more than two days a week, it will be tough sledding for retailers, bars, and restaurants.

Go Kings, more Cowbell, and light the BEAM

It isn’t too bad, so it seems,

Here’s to Aftershock, The Amgen, and the CIM

Sac will thrive, once again!

The big four commercial real estate market segments are Multifamily, Office, Industrial, and Retail. Below is a brief snapshot of each. If you would like the complete report for any market segment, please contact Tom Bacon, CCIM at [email protected].

Multi Family

Coming into 2023, after two years of Covid and one year of steep interest rate ascent, virtually all speculative land acquisitions for future multifamily development had come to a standstill. Deals in contract continued to be canceled. Sometimes, a deal closes because the buyer is too vested to walk. For example, the buyer of the northeast corner of 21st and Q Street had significant non-refundable escrow deposits and successfully secured entitlements. Development of the site has not commenced, but as interest rates subside, either the site will be developed or sold to a developer.

Fortunately, Sacramento is well positioned to thrive in the coming years because it is considered the #1 MSA to relocate to if you live in the Bay Area. But even with the significant migration from the Bay Area, the vacancy factor has increased to 7.5%. Why? 2,800 new apartment units came on the market in 2023. There was approximately 1,000 units of net absorption for the year, but with the short-term surplus, rental rates actually decreased with added concessions (incentives) for new tenants.

Sacramento is considered the most affordable large market in California with average monthly rental rates around $1,760. An estimated 2,900 units are currently under construction. Once they are ready for occupancy, it will be interesting to see where rents end up and how long it takes to see vacancy rates normalize to 5%.

Over the past ten years, Sacramento has seen net absorption of 1,000 units/year. Combining the 2,900 new units coming to the market with the 1,800 currently vacant units means we are looking at a four-year period to absorb the units.

Sales of Multifamily properties totaled about $322 Million for 2023. The average for the past five years was $1.3 Billion/year. As interest rates increased, Cap Rates increased. Cap Rates are a static measure of value, and when interest rates increase, particularly as quickly as they have, investors require a higher return on their investment. Also, if a buyer is financing the purchase, the cash flow decreases when loan payments increase.

Going into 2024, we can look forward to the continued immigration from the Bay Area absorbing new apartment units. As interest rates decline, some renters might transition into homeownership. However, given the significant supply constraints, residential prices will creep up if interest rates go down. Time will tell if this sways potential homebuyers towards remaining renters.

Office

At 11.2%, Sacramento’s vacancy rate has stayed below the 14% national average since 2019. However, the real vacancy rate for Sacramento is probably around 15% while the national rate is approaching 18%.

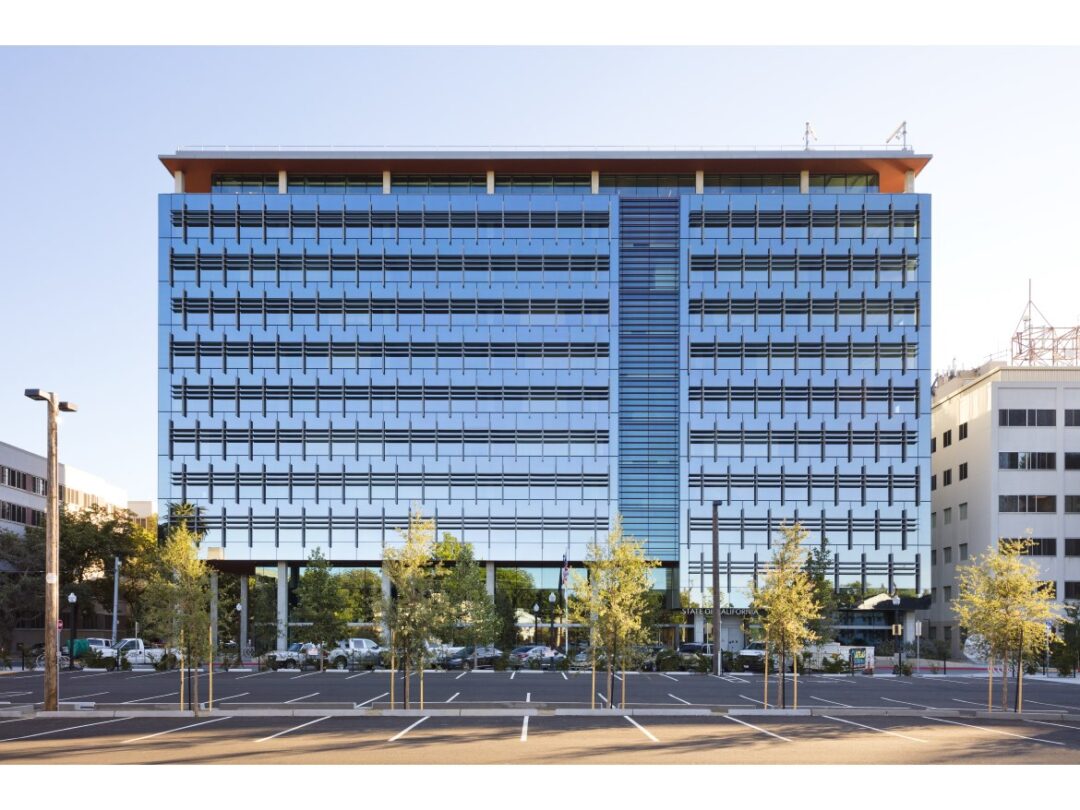

Historically, Sacramento has relied on the State of California to bolster the office market. But this has changed significantly since the State began consolidating into state-owned and developed office properties. Over 1.5 million SF was developed on O Street, and 1.2 million SF is nearing completion on Richards Boulevard. In addition, the Department of General Services instituted aggressive WFH policies that if maintained, will create significant blocks of open space as leases expire.

The private sector has diversified considerably over the years, and Sacramento would be recession-proof for a while. Sacramento’s office market is not overbuilt, but it is underutilized.

Most office properties are selling at a significant discount. Costar reports that recent office sales suggest that vacant properties have lost 30% of their value. In the last few deals, properties are selling for under $100/SF. A few recent sales have dropped to $65/SF. These buildings suffer from significant vacancy.

In Q4 of 2019, the price per square foot for office space hit $260. For Q4 of 2023, the prices have fallen to about $139/SF. The projections for 2024 are lower.

However, Sacramento is better positioned than most other markets because there has been virtually no speculative development. Sacramento’s private sector demand for office space is gradually increasing compared to the SF Bay area. Most of this demand comes from local companies that will use their expiring leases as an opportunity to secure a space that better meets their needs. If a Tenant moves, they are typically downsizing and moving into a nicer space.

Industrial

Sacramento’s Industrial Market has been on a tear for the last 4 years thanks to its new modern industrial developments and strategic NorCal location with linkages to all major freeways and rail lines. Despite the 3.9 million SF developed over the last year, demand exceeded the new supply by about 970,000 SF.

Nearly 1.7 million SF was leased in 2023, exceeding 2022. However, this is not indicative of what is to come. Many older buildings with low clear heights (functionally obsolete) sit vacant longer. Demand from Third Party Logistic Companies (3PL) has slowed due to a decline in e-commerce sales. The overall market vacancy is near an all-time low, and Costar predicts that the vacancy will sit at 5% by the end of 2024. This prediction isn’t too bad Considering the historical average is about 9.6%.

Sacramento Industrial Rents are averaging $11.10/SF and the buildings that comprise this sample include smaller flex properties that rent for considerably higher, around $14/SF. According to Costar, rent for large distribution space varies depending on the age of the building and location. Newer construction rents exceed $10/SF, while older buildings in Woodland have leased for as low as $6.60/SF.

New industrial construction in Sacramento is approximately 2.5 million SF, and most new projects have at least 32 feet clear heights. The bulk of this new construction is in Metro Air Park, near Sacramento International Airport. Development costs have nearly doubled from about $40/SF before the pandemic to $80/SF.

On the sales side, the five-year average is $890 million, but for 2023, the total is less than $650 million. Prices are softening, and according to Costar, Cap rates have increased about 100 basis points.

Retail

Pizza and Chipotle sales are up!

Did you say recession? If you haven’t noticed, Sacramento’s finest still like to shop! Going out to dinner is expensive, but people still go. The last time I dropped off shirts at the dry cleaner, the price jumped from $1.25/shirt to $3.50! I’ll admit, I contemplated going “old school” and ironing my shirts, but there comes a time when it just makes sense to support our neighborhood dry cleaners. Besides, since the Pandemic changed the world in 2020, I’ve only worn a button-down 15 times.

Near the end of 2022, Sacramento’s retail vacancy rate was 5.8%. Today we are looking at 6.3%, which is still below the five-year average of 6.8%. Not all submarkets are the same, though. Newer submarkets like Folsom and Elk Grove have lower vacancy rates while older neighborhoods like Citrus Heights and Carmichael are 10% or higher.

Retailers like Falling Prices, Grocery Outet and Fitness operators were the most active larger users, but the majority of the leasing demand came from users under 5,000 SF.

In the Sacramento region, rents have reached $2.00 NNN PSF, but rent growth has slowed as sales have plateaued because retailers have been challenged by increased operating costs (consider minimum wage).

New Construction Continues.

The biggest projects include Costco in Natomas and in Roseville. Whole Foods is under construction in Elk Grove, and Sky River Casino just opened up. There will be additional growth related to the Casino.

Retail properties, particularly grocery-anchored centers, are a favorite amongst investors. Retail values will hold their own, with no chink in the armor. Since the Pandemic, Sacramento has benefitted from quality demographic migration from the Bay Area.

No properties (like Starbucks and Chipotle) nationwide have seen cap rates climb, but when cash is king, and an investor needs to put the cash somewhere, quality credit operators, like Chipotle, command record-setting prices.