I watched a presentation about the economy and the implications for commercial real estate KC Conway, a well-known CRE economist was the presenter. Here are the Key takeaways:

- Inflation: The published CPI is running at about 8% annually, but we all know that the real CPI is significantly greater. Energy costs drive up the cost of virtually everything. One way this affects commercial real estate is that operating cost increases exceed rent increases. This is significantly more dramatic in office buildings since rents are flat or declining while the owner is picking up most of the operating expenses. Sure, tenants pay operating expense pass-throughs, but either there are built-in caps as to how much the tenant pays or when a tenant’s lease gets renewed, their Base Year gets reset. With this said, real estate is a great hedge against inflation, and this is why we continue to see capital flow into CRE investments, particularly Industrial and Multi-Family.

- Expense Growth vs. Rent Growth: As expense increases outrun rent increases, the Net Operating Income “NOI” for a property (particularly office) goes down. Since values are primarily dictated by cash flow, as the NOI goes down, the value of the real estate decreases.

- Monetary Policy: The FED is increasing interest rates to slow down inflation. The problem is that FED actions do not influence inflation in other economies. So when we buy products from other countries, say for manufacturing cars, semiconductors, or nickel for batteries – the cost of producing these goods still go up and the increases are passed onto the consumer. Mexico is a primary trading partner, and its inflation rate is at 7.36%.

- Construction Costs: Year over a year – San Francisco is up 15.4% and LA is up 14.4%. Sacramento was not mentioned, but it sure feels higher than 15%. I think that when you factor in the cost of labor, the increases are closer to 20%. So, with costs so high, when a tenant is looking at the prospect of moving into a new office, they might think twice about moving because the tenant improvements could prove to be prohibitive. Rapidly increasing costs of construction make budgeting and underwriting projects really difficult.

- Build or Buy Existing?: Development is a risky and expensive vocation. Costs combined with the shortage of materials and labor exacerbate development risk. So, it makes sense to buy existing properties that can be repurposed to a different use – say office to residential. This is why you are seeing a record number of older multi-family properties sell these days, at historically low cap rates.

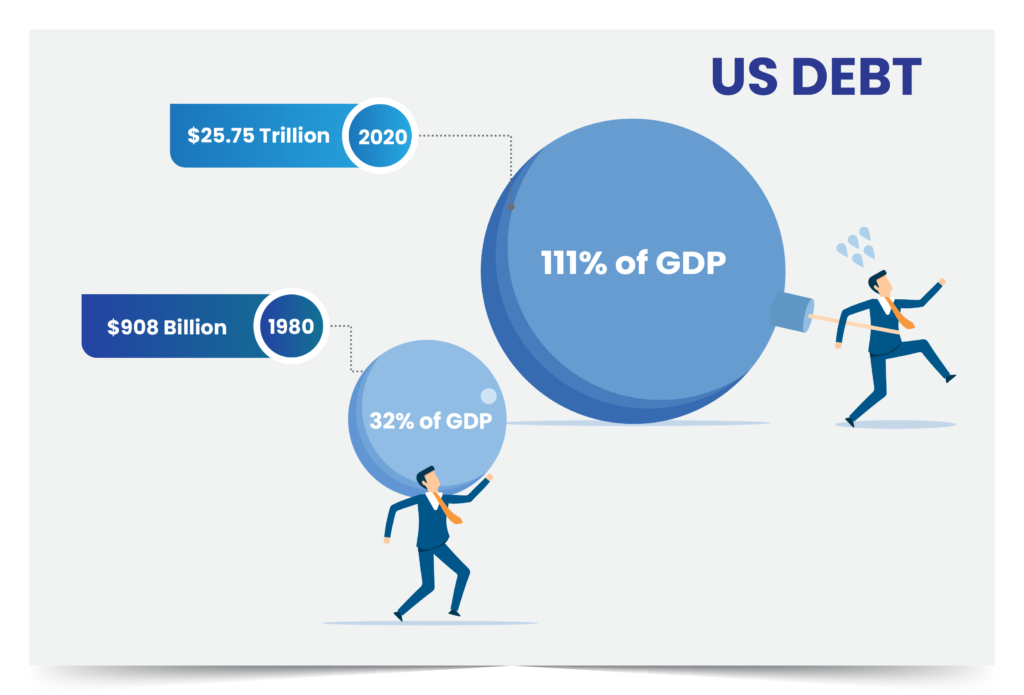

- US Debt: The total debt of the US has increased significantly.

I wonder how we are looking since the Pandemic and the Geopolitical upheaval?

The presentation gets into specific commercial real estate market segments, and it is worth a look. Check it out here: CRE Economics .